Ever been hit by sudden costs? Medical bills, car repairs, job loss – life sure knows how to surprise us.

I’ve been in the same boat, often needing extra cash to make ends meet. My solution? Payday loans.

Now, I want to be clear. Payday loans aren't for everyday use and can get you into a sticky financial mess if you're not careful. But if you use them wisely, they can bail you out in a pinch.

After trying many out, I've put together a list of my top seven payday loans.

- ZippyLoan: Borrow from $100-$15,000, with potential credit score improvement. Fast approval and cash in your account.

- MoneyMutual: Trusted by 2M+ customers, offers loans of $100-$5,000 with fast access to funds.

- Dollar Loan Club: Fast approval for loans up to $3,000.

- VivaLoan: Flexible loans from $100-$15,000, with opportunities to improve credit score.

- Check Into Cash: A seasoned direct lender providing loans from $50-$1,500, both online and in-store.

- Max Lend: Offers loans from $100-$3,000, featuring a rewards system for timely repayments.

- Bad Credit Loans: Specializes in loans from $500-$10,000 for individuals with poor credit.

I've chosen them based on their speed, terms, and customer service. Remember, these are for emergencies only, but when that time comes, I hope my list will help you make the right choice.

So, let's dive into these top payday loan options that got me through the tough times.

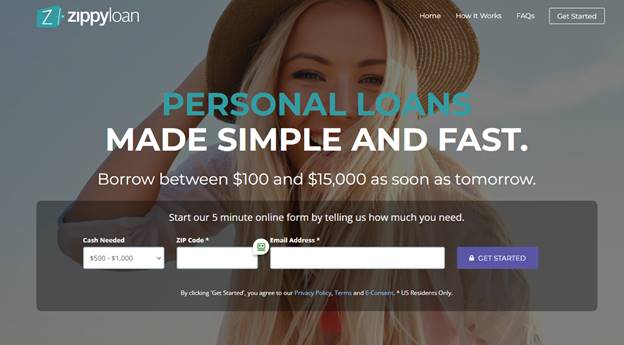

1: ZippyLoan

When I was in a financial crunch, ZippyLoan was my top choice for a payday loan service. Its mantra of making personal loans simple and fast truly delivered.

With ZippyLoan, you can borrow anywhere from $100 to $15,000 and receive the money as soon as the next day.

The application process is a breeze; just fill out their online form, which takes about 5 minutes, and they'll connect you with the most suitable lender from their extensive network.

Once approved, your funds are directly deposited into your bank account.

All credit types are welcome at ZippyLoan, but applicants must be over 18 and have a regular income source.

Moreover, timely repayments might even help improve your credit score.

However, it's worth noting that residents of New York, West Virginia, Oregon, or the District of Columbia cannot access their services.

A member of the Online Lenders Alliance, ZippyLoan ensures full compliance with federal laws and is dedicated to protecting consumers from fraud.

Once you've been paired with a lender, you simply e-sign your loan agreement, and the money will be in your account the following day.

The loan agreements are flexible. You can take up to 60 months to repay, or if you prefer, you can repay on your next payday.

The APR ranges from 12% to 36%. As an illustration, if you borrow $2,000 with an APR of 12% on a 24-month repayment plan, you'll repay a total of $2,259.60.

The exact amount you can borrow and your repayment terms vary based on individual circumstances.

The best way to get a clear picture is to fill out their short online form and explore the best offers ZippyLoan provides for you.

Before you agree to a loan, ensure you thoroughly read the terms and conditions, understand your repayment obligations, and know exactly how much you will have to pay back.

In the midst of a financial emergency, ZippyLoan could be your much-needed life raft.

Click here to visit the ZippyLoan website and apply for the quick cash you need today.

2: MoneyMutual

In the diverse world of payday loan services, MoneyMutual stands out as a reliable and efficient platform.

If you're looking to borrow anything from $100 to $5000 swiftly, then MoneyMutual is worth checking out, based on my experience.

This trusted financial partner has already helped over 2 million customers, a testament to their credibility and dependability.

As a member of the Online Lenders Alliance, MoneyMutual adheres to the highest standards of operation, which adds a layer of trust and reliability.

When you're stuck in a financial jam and need to get a hold of funds quickly, MoneyMutual lives up to its promise.

Their service enables you to have funds, up to $5,000, transferred to your account within as little as 24 hours – a godsend when facing an unexpected financial hurdle.

Their user-friendly interface and swift application process make things even easier.

All it takes is completing a straightforward online form. This information is then securely passed on to their network of online lenders.

These lenders analyze your information and extend loan offers tailored to your circumstances. You can then review these offers at your leisure and select the one that best fits your needs.

Once you've selected an offer, the approval process is quite speedy. Upon accepting the loan terms and e-signing the agreement, you can expect to see the loan amount deposited into your account in less than 24 hours.

This quick turnaround can be particularly beneficial when you're strapped for cash and need a solution quickly.

The interest rates offered through MoneyMutual vary, generally falling between 8 to 40%.

The exact rate, as well as the total repayment amount, depends upon your personal financial circumstances.

As with any financial service, there are a few restrictions to be aware of: MoneyMutual's services are not accessible to residents of New York, and to qualify for a loan, applicants must be at least 18 years old and earn a minimum of $800 per month.

One word of caution – always ensure you have a repayment plan before borrowing money.

It's essential to review the terms and conditions meticulously to avoid any unexpected surprises and ensure you're comfortable with the loan repayments.

As long as you stay mindful of your commitments, MoneyMutual can provide a much-needed financial lifeline in a time of need.

Click here to visit the MoneyMutual website and see how much you can borrow today.

3: Dollar Loan Club

Dollar Loan Club, with its motivating slogan “Borrow Today for a Better Tomorrow,” comes in as my third pick on this list of the best payday loans.

This provider prides itself on its swift lender approval process, ensuring you're connected to a loan that suits your circumstances.

Starting your loan journey with Dollar Loan Club is as simple as filling in a short online form.

Once you've provided the necessary details, they immediately set to work, connecting you with an approved lender from their extensive network.

Their streamlined process makes it straightforward to secure the funds you need without unnecessary delays.

Applicants must meet a few basic criteria to use Dollar Loan Club's services: you need to be over 18, currently employed, and earn at least $1,000 per month.

The good news for those with a less-than-perfect credit history is that you can still secure a loan with Dollar Loan Club.

They understand that everyone's situation is unique, and try to accommodate even those with bad credit.

Interest rates through Dollar Loan Club can vary widely. The exact rate you're offered will depend on several factors, including the specific loan provider you're connected with and your credit score, among other considerations.

Although they may not be as speedy as ZippyLoan or MoneyMutual, Dollar Loan Club ensures that, once approved, you'll receive the money in your account in less than 48 hours.

While this might be a slightly longer wait, their commitment to accommodating a wider range of borrowers makes them a service worth considering.

In conclusion, although Dollar Loan Club might not be the fastest option, their inclusive approach and commitment to helping their customers “borrow today for a better tomorrow” make them a sound choice when you need some quick cash.

Click here to visit the Dollar Loan Club and see how much you can borrow today.

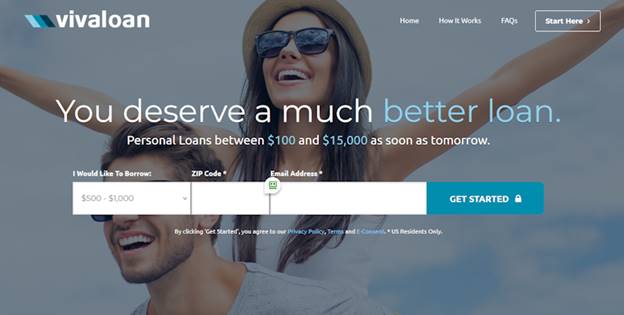

4: VivaLoan

My fourth recommendation is VivaLoan, a provider known for its simple application process and flexible repayment options.

If you need to borrow anywhere from $100 to $15,000, VivaLoan could be an excellent choice for you.

Applying for a loan with VivaLoan is a straightforward process.

Simply fill in their online form, and they will connect you with an approved lender from their network who will present you with a loan offer.

Their platform is welcoming to all credit scores, making them a good option whether your credit history is impeccable or a bit bumpy.

One of VivaLoan's standout features is its speed. Once your loan is approved, you can have the money in your account as soon as the next day, which is great for financial emergencies.

VivaLoan also offers flexible repayment options. Depending on your circumstances and the loan agreement, you have the option to repay your loan over several months or make a single payment.

Plus, timely payments can help you improve your credit score – an added benefit of using their service.

Like some of my other recommendations, VivaLoan is part of the Online Lenders Alliance, which reinforces its commitment to best practices and legal compliance.

To be eligible for a loan with VivaLoan, you must be over 18 and have a regular source of income.

It's important to note, though, that before accepting any loan, you should thoroughly check the terms.

Make sure that you are comfortable with the repayment schedule and confident that you can make payments on time.

Failing to repay a loan on time can lead to further financial trouble. Therefore, borrowing responsibly is key.

In conclusion, with its flexible and accessible loan options, VivaLoan is a valuable resource when you need a financial boost.

Click here to visit the VivaLoan website and see how much you could borrow today.

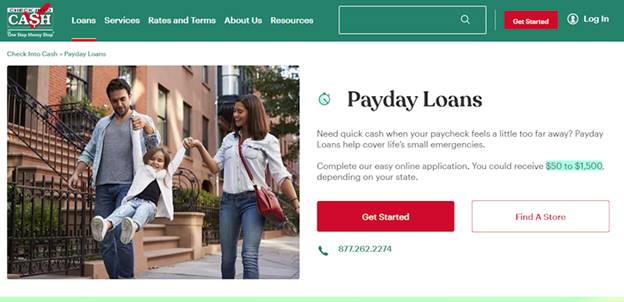

5: Check Into Cash

The fifth payday loan service on my list is Check Into Cash, which prides itself as the “One Stop Money Shop”.

This direct lender has over three decades of experience in the field, demonstrating their commitment and expertise in helping customers navigate their financial needs.

Check Into Cash sets itself apart from purely online lenders by also offering over 300 physical store locations across the U.S.

This means you can choose to walk in and speak to a representative in person if you prefer or utilize their online service from the comfort of your own home.

Their loan amounts range from $50 to $1,500, catering to a wide variety of needs, from small emergencies to larger unexpected expenses.

The premise is simple – borrow what you need and pay it back on your next payday.

Eligibility for a loan with Check Into Cash requires you to be over 21.

It's also worth noting that the exact amount you can borrow and the total repayment amount depends on both your personal circumstances and the state you reside in, as different states have varying laws regarding payday loans.

The application process is straightforward: fill out their online form and receive an offer.

Once you're happy with the terms and rate, you can e-sign the loan agreement, and typically, the money will be in your account in less than 24 hours.

Overall, Check Into Cash, with its years of experience, physical presence, and direct lending system, is a reliable and practical choice for a payday loan.

However, as always, make sure you're comfortable with the terms of the loan and confident in your ability to repay on time before accepting the loan.

Click here to visit the Check Into Cash website and see how much you can borrow today.

6: Max Lend

Max Lend, the sixth payday loan service on my list, offers a unique and appealing feature: a rewards system that benefits you for your reliability.

This provider allows you to borrow anywhere from $100 to $3,000, covering a broad spectrum of short-term financial needs.

What sets Max Lend apart is their rewards program. By consistently repaying your loans on time, you can earn lower rates on future loans and become eligible to borrow larger amounts.

This feature adds an incentive to maintain good borrowing habits and can be especially beneficial for regular users of their service.

Max Lend is open to all credit scores, making it a viable option whether you have an excellent credit rating or are working to improve it.

To be eligible for a loan, you must be over 18. However, their services are not available in Arkansas, Connecticut, Georgia, Hawaii, Illinois, Massachusetts, Minnesota, New York, North Dakota, Pennsylvania, Vermont, Virginia, Washington, or West Virginia.

When it comes to fees, Max Lend charges a fee per $100 borrowed, ranging from $14.75 to $59.

For example, if you borrow $100 for one month, you could end up paying back up to $159. While these rates might seem high, it's essential to remember that higher rates are quite typical for payday loans due to the short-term and unsecured nature of this type of lending.

As with all loans, it's crucial to understand the repayment terms before you e-sign the loan agreement.

If you're comfortable with the terms and confident in your ability to repay on time, Max Lend can be a practical choice that rewards you for good financial behavior.

Click here to visit the Max Lend website and see how much you can borrow today.

7: Bad Credit Loans

Rounding off my list of top payday loan services is Bad Credit Loans, a provider that takes a straightforward approach to accommodate borrowers with less-than-perfect credit histories.

As their name suggests, they specialize in providing loans for individuals who have had difficulty securing financing due to their credit scores.

Bad Credit Loans offer borrowing amounts ranging from $500 to $10,000, accommodating a wide variety of needs.

The APRs for their loans range from 5.99% to 35.99%, depending on various factors such as your credit score and the loan term.

Applying for a loan with Bad Credit Loans is uncomplicated.

By filling out a simple online form, they can match you with the best loan from their extensive network of lenders.

This service saves you time and effort, as you won't need to seek out and apply with multiple lenders individually.

Despite focusing on bad credit loans, this provider maintains an efficient service.

Once you've filled out their form and approved the loan offer, you can expect to have the money deposited into your account within 48 hours.

This makes Bad Credit Loans a reliable option for emergencies when you need to secure funds quickly.

In conclusion, Bad Credit Loans is a go-to resource for those with bad credit scores, offering a simple and easy-to-use platform that connects you with suitable lenders.

Their speedy process and flexible loan amounts make them an excellent final choice in my list of top payday loan providers.

Click here to visit the Bad Credit Loans website and see how much you can borrow today.

Best Payday Loans Recap

Emergency financial situations can be stressful, but having access to a reliable payday loan service can help alleviate some of that stress.

The seven services we've discussed offer various benefits, with each having unique features that cater to different needs and circumstances.

Let's briefly recap:

- ZippyLoan: Offers personal loans between $100 and $15,000, with quick online applications and the potential to improve your credit score with timely repayments.

- MoneyMutual: Trusted by over 2 million customers, they allow you to borrow from $100 to $5,000 with a quick turnaround of funds.

- Dollar Loan Club: Promises fast lender approval for amounts up to $3,000, even for those with bad credit.

- VivaLoan: A flexible provider allowing borrowing between $100 and $15,000, with the possibility of credit score improvement through regular payments.

- Check Into Cash: A veteran direct lender with both online and in-store services, offering loans from $50 to $1,500.

- Max Lend: Provides loans from $100 to $3,000 and features a rewards system for timely repayment, beneficial for frequent borrowers.

- Bad Credit Loans: Specializes in catering to individuals with poor credit, offering loans from $500 to $10,000.

Remember, the key to using payday loans effectively is understanding the terms and ensuring you can comfortably repay the loan.

While the interest rates may be higher than traditional loans, the convenience and quick access to funds can be a lifesaver in emergency situations.

To choose the right service for you, consider the amount you need, how quickly you need it, and what you can afford to pay back.

Regardless of your choice, remember that payday loans are a short-term solution and should not be used as a long-term financial strategy.

Finally, never be afraid to reach out for help if you're struggling financially.

There are numerous resources and services available to assist you. Financial peace of mind is achievable, and choosing the right payday loan service is a step in that direction.